Organic Continues Double-Digit Gains

As organic increases after year, recent surveys have some of us wondering: How much can organic grow amid continued consumer confusion?

Last year was another banner one for the organic industry. SPINS tracked a 12 percent increase in sales of organic products across all channels, and the Organic Trade Association reported that a whopping eight in 10 parents now buy organic at least some of the time. “I would characterize the industry as exploding,” says OTA Executive Director Christine Bushway. “It was an incredible year of double-digit growth across many categories.”

Although there are many positives, the news is not all good for organic. Some industry observers—and several recent surveys—point out that mainstream consumers still don’t grasp what the USDA Organic seal means or how it benefits them, and many view it with suspicion. If this problem isn’t solved, the organic bubble could burst, fears Maryellen Molyneaux, founder and president of Harleysville, Pa.-based Natural Marketing Institute. “Consumers are very confused, and it is not getting better,” she says.

New categories and newcomers

Looking first at the good news, industry observers say organic’s steady post-recession return to double-digit growth has been driven significantly by longtime organic consumers broadening their purchases across more categories, such as textiles, body care and supplements. “People interested in organic are considering not just what they put in their bodies, but also what they put on their bodies,” Bushway explains.

Click here to get the complete 2013 Market Overview with all of the charts and data included.

For instance, organic mattresses and cotton textiles are “going gangbusters,” she says. With organic cotton retail sales rising 20 percent, from $4.3 billion in 2009 to $5.16 billion in 2010, according to the 2010 Global Market Report on Sustainable Textiles. “Now you can buy reasonably priced organic bed linens at Target and Walmart.” Also, according to SPINS, sales of organic body care products climbed a jaw-dropping 34.9 percent across natural and conventional channels in 2012, while organic vitamins and supplements increased 20.2 percent.

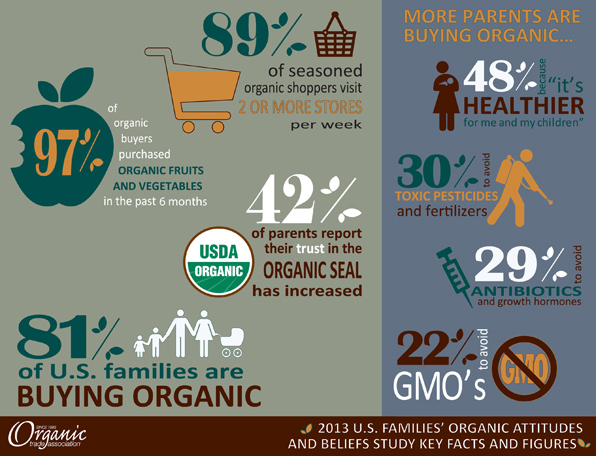

Besides committed consumers buying more, organic continues to slowly attract newcomers, many of them parents drawn to the U.S. Department of Agriculture’s Organic seal out of concern for their families’ health. According to the OTA’s U.S. Families’ Beliefs and Attitudes study, 81 percent of surveyed families say they buy organic (up from 73 percent) in 2009. Forty-one percent are “new entrants” to the market, and nearly half say they buy organic food because it is “healthier for me and my children.” As for what items these shoppers are buying, 97 percent said they purchased organic fruits or vegetables in the past six months, while 85 percent bought breads and dairy.

Organic baby food spiked in 2012, driven in part by the massive mainstream expansion of Plum Organics and its squeeze-pack baby food. (Plum brought in $80 million in 2011 and made the Inc. 500 list of the nation’s fastest growing companies.) “With organic baby food, parents are really getting on board,” says Kurt Jetta, CEO of the TABS Group, a Shelton, Conn.-based consumer analytics company.